pay ohio unemployment taxes online

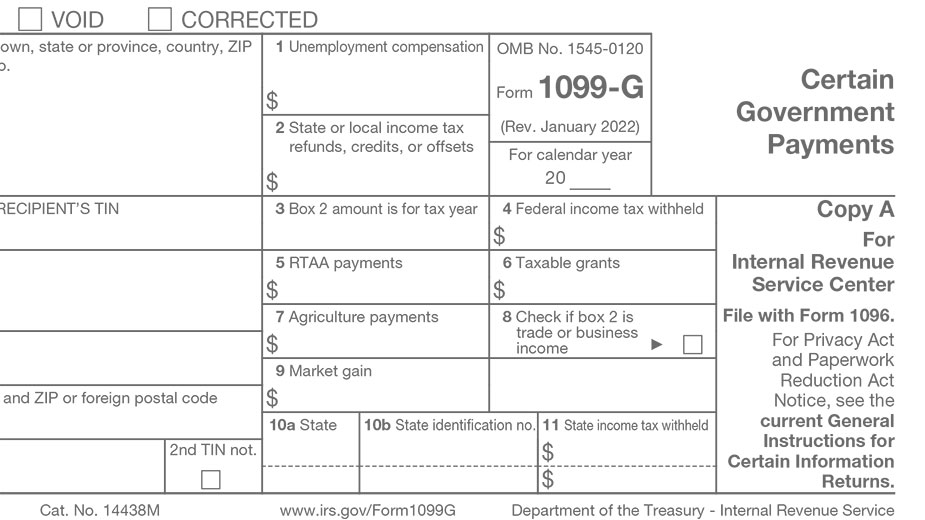

ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes.

Odjfs Online Office Of Communications Communications Health Care Health

Top Ten Home Alarm Systems Top Rated Home Security Companies Top 10 Best Security Systems.

. Apply for Unemployment Now Employee 1099 Employee Employer. If you have an existing PUA account you still can access it by entering your Social Security number and password below. Up to 25 cash back The two sections are considered a single report for filing purposes.

How to get online access to The SOURCE. 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update. Mail the repayment to.

Offer helpful instructions and related details about Pay Ohio Unemployment Taxes Online - make it easier for users to find business information than ever. Department of Labors Contacts for State UI Tax. Changes in how Unemployment.

Agent Uploading Ohio Quarterly Unemployment Files pdf. Ohio Department of Job and Family Services. Please review the various options employers have to submit their quarterly reports electronically.

Education credits Guest Payment Service renaming of Ohio schedules and more. If you are having problems logging in select the. To file and pay online you can use either the ERIC system or the.

You can pay using a debit or credit card online by visiting ACI Payments Inc. Online Services is a free secure electronic portal where you can file and pay your Ohio individual and school district income taxes. File Unemployment Taxes Online.

Employer Credentialing and Agent Credentialing. Please allow 2-3 business days for. You can file your reports and payments online or on paper.

Report it by calling toll-free. To file on paper use Form JFS-20125 Quarterly Tax Return which contains both required sections. Report it by calling toll-free.

File Unemployment Taxes Online. Updated 5262021 - Unemployment Benefits for Tax Year 2020. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

Please visit httpsthesourcejfsohiogov to enter your quarterly reports online. To file and pay online you can use either the ERIC system or the Ohio Business Gateway. The SOURCE or the State of Ohio Unemployment Resource for Claimants and Employers is Ohios internet-based unemployment tax system.

This payment method charges your credit card Discover Visa MasterCard or American Express. JFS-20106 Employers Representative Authorization for Taxes. Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 35 on supplemental compensation such as bonuses commissions and other nonrecurring types of payments other than salaries and wages.

You may also use the Online Services portal to pay using a creditdebit card. Allows you to viewprint transcripts of previously filed returns up to 10 years and Ohio 1099-G1099-INT forms up to 5 years. Learn about Ohio unemployment benefits from the Ohio Department of Job and Family Services.

When you enter wage information The SOURCE automatically calculates the taxable wages and contributions taxes due for you eliminating many common calculation errors. If you have questions contact the Office of Unemployment Compensation Division of Tax and Employer Service at 614 466-2319. The SOURCE Upload File.

Logging in to The SOURCE for the first time. Expand All Sections Web Content Viewer. You can pay using a debit or credit card online by visiting ACI Payments Inc.

Its a one-stop shop where employers and third-party administrators can manage all their business related to unemployment contributions including registering new businesses filing quarterly reports and making tax payments among. Also used by employers to authorize the Ohio Department of Job and Family Services to furnish information. New Income Tax Rate.

Your Unemployment Tax Rate can also be found on the annual Tax Rate Notice in box 2. Using the online option reduces your tax return preparation time. Changes in how unemployment benefits are taxed for tax year 2020.

If you need to file an appeal please visit PUAAjfsohiogov. The Ohio Department of Job and Family Services Mike DeWine Governor Matt Damschroder ODJFS Director. In addition The SOURCE allows employers and third-party administrators to manage all their business related to unemployment contributions online including registering new businesses.

Your account will be locked after 3 unsuccessful attempts. If you DID apply andor receive unemployment benefits from ODJFS. Ohio income tax update.

What are the consequences of failing to file or pay unemployment insurance taxes. It is available 24 hours a day 7 days a week except for scheduled maintenance. JFS 20233 Employers Guide to Wage Report and Payment File Specifications.

In accordance with Toledo Municipal Code 1905011 effective January 1 2021. To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. If you have any questions or concerns about making a repayment please call 614-995-5691 option 3.

As a result PUA claims are no longer being accepted. The SOURCE or the State of Ohio Unemployment Resource for Claimants and Employers is Ohios internet-based unemployment tax system. Unemployment benefits are taxable pursuant to federal and Ohio law.

Most employers pay both a Federal and a state unemployment tax. Beginning January 1 2018 employers are required to submit their quarterly reports electronically. You can also review notices and information about those taxes from the Department.

42 Ohio law requires that I withhold Ohio income tax on employee compensation. Mailing address telephone number andor email address with the Department. JFS should send you preprinted forms.

You can also view outstanding balances if any and update certain contact information ie. You will be redirected to the ACI Payments Inc.

Unemployment Insurance Ohio Gov Official Website Of The State Of Ohio

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

How To Apply For Unemployment Benefits Online In Ohio Youtube

If You Have Employees Who Work In One State But Live In Another You Might Need To Know About Tax Resume Examples Introduction Letter Child Support Enforcement

Some People Not Receiving Unemployment 1099 G Tax Forms

Ohio Department Of Taxation Facebook

Ohio Waivers Now Available For Pandemic Unemployment Overpayments Cleveland Com

Ohio Income Tax Update Unemployment Benefits Whalen Company Cpas

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

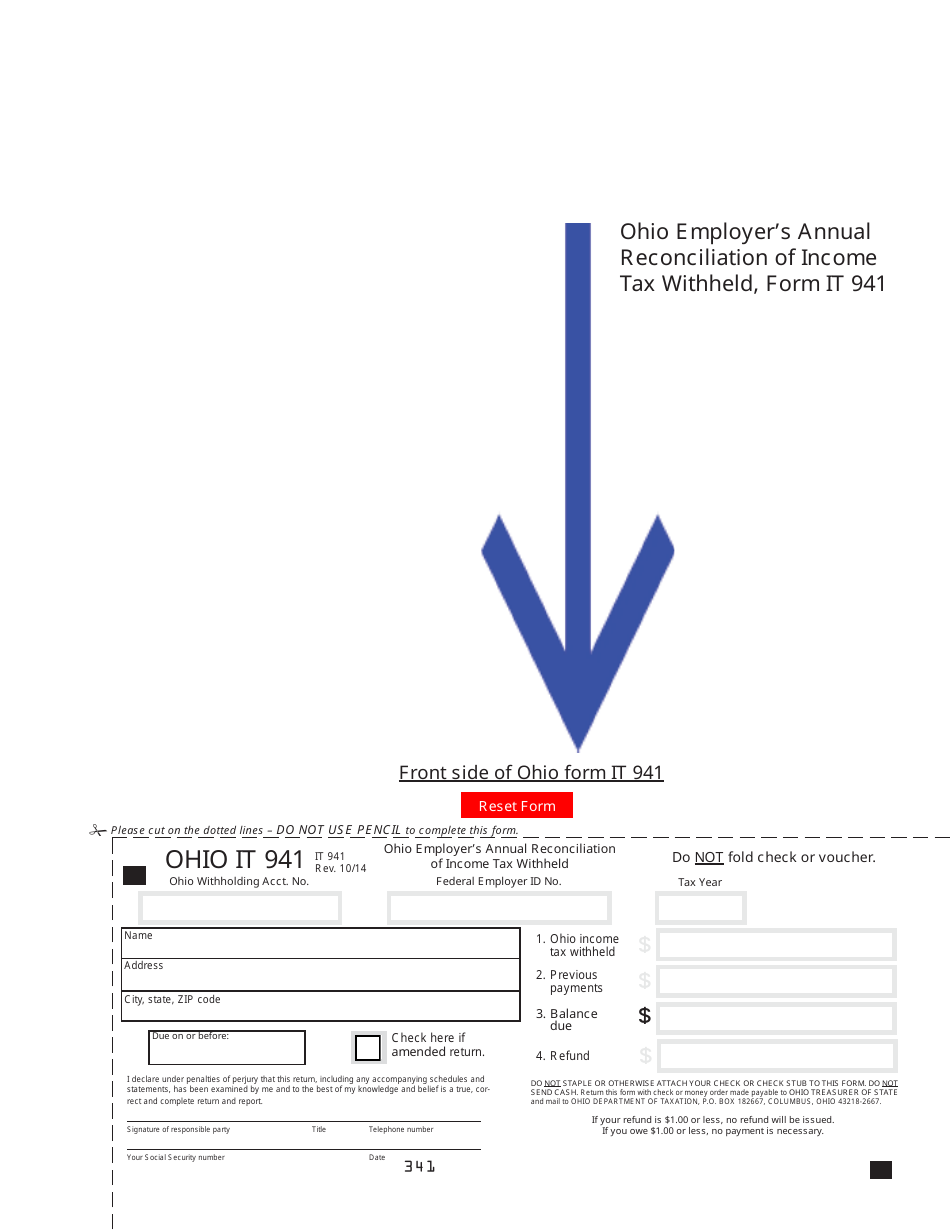

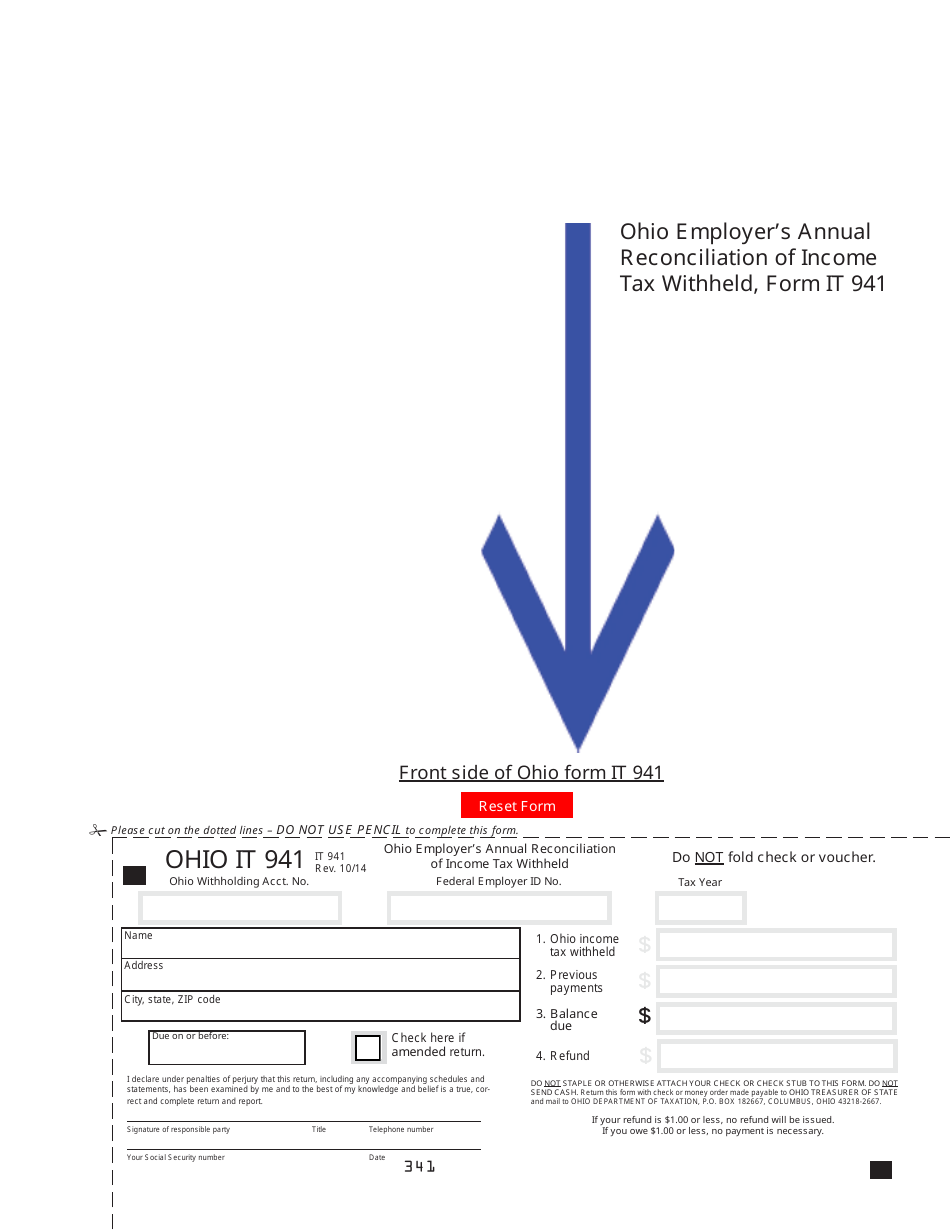

Form It941 Download Fillable Pdf Or Fill Online Ohio Employer S Annual Reconciliation Of Income Tax Withheld Ohio Templateroller

About 20 000 Unemployed Oh Workers Still Waiting For 1099 G Tax Forms